1119724-A AJL 932143 GST Reg. CIBIL Tax Bank IFSC Code Indian Holidays Saving Schemes In The News.

Repairing My Macbook Pro Macbook Pro Repair Lettering

Tri-axle roadtrain dolly hendrickson HXL7 airbag suspension alcoas jost 5090mm sidetipper hydraulics 85000 plus gst 8500 total 93500 4 available also available for long te.

. The state finance. View GST Invoice of your travel. Eligible businesses can avoid these rates with a valid VAT or GST ID.

Cancel reply Leave a Comment. The GSTIN will be provided based on the state you live at and the PAN. Tax invoices sets out the information requirements for a tax invoice in more detail.

Her business used to fall under SSIC code 47910. To prevent tax evasion and corruption GST has brought in strict provisions for offenders regarding penalties prosecution and arrest. History of GST in India.

We list key GST changes in India for 2022 which impact the scope of supplies and enforcement mechanisms withdraws concessions introduces input credit restrictions etc. Lee has an online dress shop. It is given randomly in alphanumeric code.

HSN Code List for GST in pdf HSC Codes in Excel Format Find HSN Code for Your Business. John subtracts his GST credit from the purchase price 1100 - 100 GST 1000 and uses 1000 to calculate the deduction he is entitled to in his tax return. Jabatan Kastam Diraja Malaysia Kompleks Kementerian Kewangan No 3 Persiaran Perdana Presint 2 62596 Putrajaya.

Besides extending the scope of e-invoicing rules. Adalah dimaklumkan bahawa Portal MyGST ini tidak lagi dikemaskini semenjak GST dimansuhkan pada 31 Ogos 2018. One-time Password OTP with Security Code for Secured Transactions.

Check GST rates registration returns. The place localitydistrictstate of the buyer on whom the invoice is raised billed to must be. It will now change to SSIC code 63203.

There are 21 offenses under GST. REGISTER LOGIN GST shall be levied and charged on the taxable supply of. As the name depicts OTP is only valid for one transaction.

GST - Know about Goods and Services Tax in India with various types and benefits. Rs 25 Respective State Goods and Services Act 2017 or Union territory Goods and Services Act 2017. Name of the Act Late fees for every day of delay.

Starting January 1 2022 several key amendments in the goods and services tax GST regime will be implemented. What is GST. For issuance of proper tax invoice by the airline please ensure that GSTIN in capital letters name of GSTIN Customer and e-mail address are correctly mentioned at the time of booking whether.

Exemption does not apply on B2B. Visit the ViewChange bookings option on the homepage of our website which has a list of features that allow you to retrieve and re-print your itinera. Recipients State Code.

We have mentioned a few here. Foreign direct investment FDI remained the major contributor accounting for 709 per cent of the approved investments with. Once the criteria are fulfilled and proper documents are submitted accordingly it is just a matter of time when SSM in Malaysia approves a particular LLP business.

The place of supply state code to be selected here. We also created a questionnaire to help you select the most appropriate product code. Can i amend ad code under hss bill of entry after duty payment.

Customer from Malaysia Need to bill customer from Bangalore. Ramlee 50250 Kuala Lumpur Malaysia. Segala maklumat sedia ada adalah untuk rujukan sahaja.

For the entire list of 21 offenses please go to our main article on offenses. Online marketplaces for education services. Central Goods and Services Act 2017.

This is the second level protection to authenticate your transaction. Rs 25 Total late fees to be paid per day. Check out our HSN Code finder HSN stands for Harmonized System of Nomenclature which is an internationally accepted product coding system used to maintain uniformity in the classification of goods.

John can also claim an amount that reflects the decline in value of the photocopier on his tax return. This article will help you learn GST invoice format in Word PDF and Excel and how QuickBooks Online can help you generate GST ready invoices within no time. Offences Penalties Offences.

AND SAC stands for Service Accounting Codes which are adopted by. Ramlee 50250 Kuala Lumpur Malaysia. A 15-digit distinctive code that is provided to every taxpayer is the GSTIN.

Rs 50 The law has fixed a maximum late fees of Rs 10000 up to May 2021. Retail Sales via the Internet with income mainly from online sales. Place of Supply State Code.

Eligibility criteria for LLP registration in Malaysia. Your email address will not be published. December 7 2020 at 1.

Tue Aug 23 2022 244 PM 2021 HAULMARK 12 ft. 1119724-A AJL 932143 GST Reg. His business used to fall under SSIC code 85509.

Remember Me Forgot Password. It will be sent together with Security Code via SMS to your registered mobile number. See Product Tax Category.

View All Online Auctions. September 5 2019 at 323 pm. 18th Floor Menara UMW Jalan Puncak off Jalan P.

Check With Expert GST shall be levied and charged on the taxable supply of goods and services. Strategic Trade Act is an Act to provide for control over the export transshipment transit and brokering of strategic items including arms and related material and other activities that will or may facilitate the design development and production of weapons of mass destruction and their delivery systems and to provide for other matters connected therewith consistent with. The major offenses under GST are.

To verify a FastSpring Identification Number. 18th Floor Menara UMW Jalan Puncak off Jalan P. If you supply or receive an invoice that only has a figure at a wine equalisation tax-goods services tax WEG label you need further information to claim GST credits and for it to be considered a valid tax invoice.

Sehubungan dengan itu sebarang pertanyaan dan maklumat lanjut berkaitan GST sila hubungi Pusat Panggilan Kastam 1-300-888-500 atau emailkan ke ccccustomsgovmy. To register for an LLP company in Malaysia investors has to meet a list of criteria. The state must be selected from the latest list given by GSTN.

The next section in invoice is the Bill to section which contains the details of your customer. GST History. The Malaysian Investment Development Authority MIDA has said that Malaysia has attracted 1233 billion ringgit 275 billion in approved investments in the manufacturing services and primary sectors in the first half of this year.

Whether GST is applicable on the HSS-. John can claim a GST credit of 100 on his activity statement. Education Support Services NEC.

GST Registered Customers Applicable GST IGST or CGST and SGSTUGST shall be based on your GSTIN submitted for bookings and the embarking location for each leg of the itinerary. In India the idea of adopting GST was first suggested by the Atal Bihari Vajpayee Government in 2000. GSTR 20131 Goods and services tax.

Enumerated list of states. Zip code and GSTIN. Taxable and non-taxable sales.

GST is a value-added tax in Malaysia that came into effect in 2015.

Authentic Pochette Metis Reverse Fullset Pochette Metis Louis Vuitton Pochette Metis Large Leather Tote

Gst Rates 2022 List Of Goods And Service Tax Rates Slab Revision

Chanel Sales Gst Black Caviar With Gold Hardware With Card Condition Good Rm 5990 Cash Price Promotion Only Chanel Collection Chanel Brand Lady Dior Bag

Forever Living Products Price List Forever Living Products Forever Aloe Lips Health Quotes

Haylou Gst Smart Watch Worldwide Delivery

A Complete Guide On Gst Rate On Food Items Ebizfiling

A Complete Guide On Gst Rate For Apparel Clothing And Textile Products

Gst Rate Hsn Code For Services

How To Claim Back Gst Gst Guide Xero Nz

How To Register For Gst Gst Guide Xero Nz

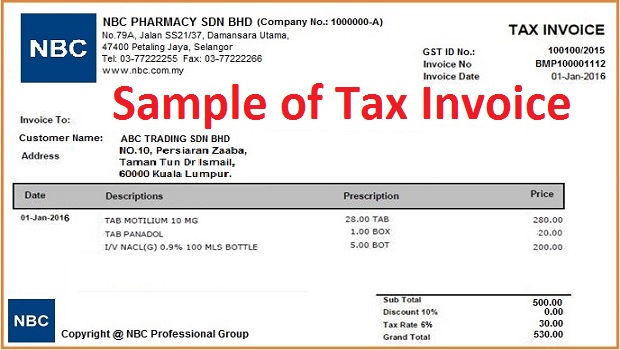

Free Resources Archives Goods Services Tax Gst Malaysia Nbc Group

Haylou Gst Smart Watch Worldwide Delivery

F1 Shirtf1 Shirt Corporate Shirts Corporate Uniforms Shirts

Statement Of Account Templates 12 Free Docs Xlsx Pdf Statement Template Bank Statement Templates

Impact Of Gst On Goods Given As Free Gifts Or Business Promotion

The Brief History Of Gst Goods And Service Tax Goods And Services Goods And Service Tax Get Gift Cards

Gst State Code List 2022 With All Details Pdf Download

32 Free Invoice Templates In Microsoft Excel And Docx Formats Invoice Template Invoice Design Template Sales Template